aurora sales tax rate

For tax rates in other cities see Ohio sales taxes by city and county. The City of Auroras tax rate is 8350.

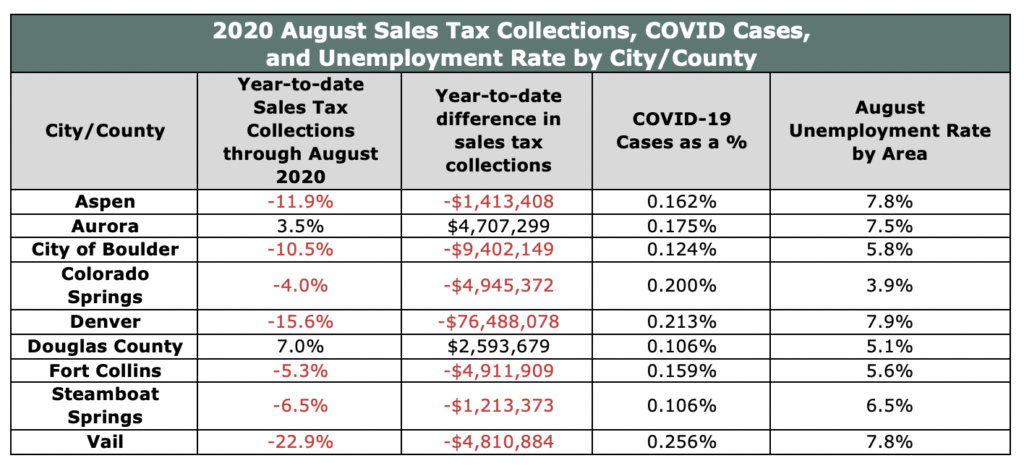

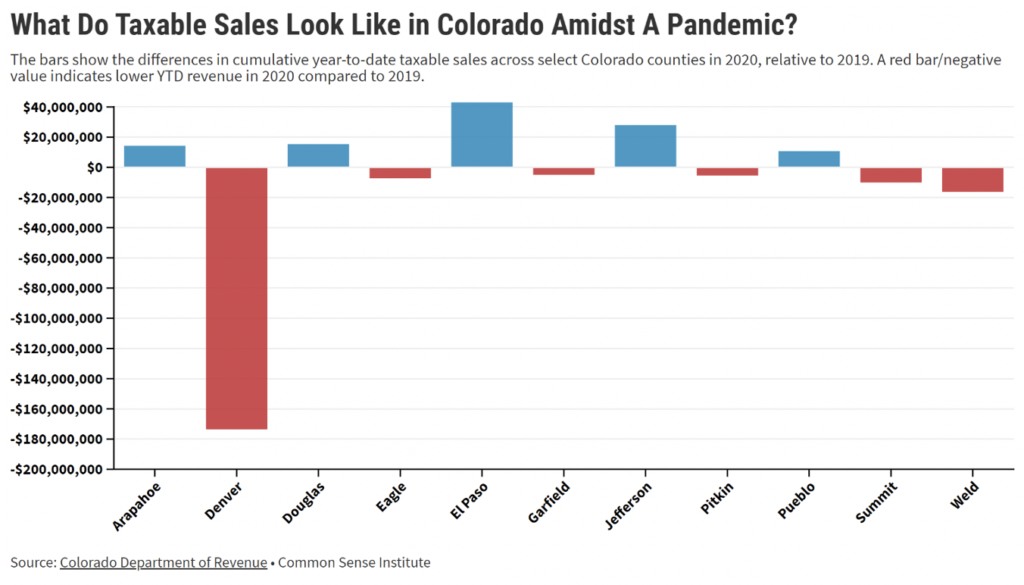

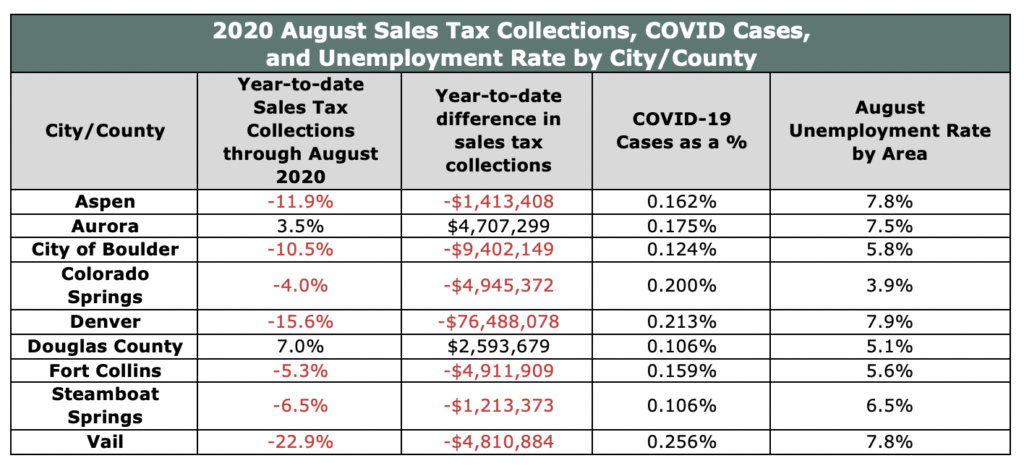

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

From agricultural outpost to military bastion Aurora established its foundation as a driving force in the west.

. You can print a 8 sales tax table here. Aurora collects the maximum legal local sales tax. The Aurora Cd Only Sales Tax is collected by the merchant on all.

Special Event Tax Return. The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city sales tax. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. 5 rows The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams. MO Sales Tax Rate.

You can print a 7 sales tax table here. There is no applicable city tax or special tax. The current total local sales tax rate in Aurora OH is 7000.

Aurora OH Sales Tax Rate. There is no applicable county tax. The County sales tax rate is.

There is no applicable county tax. The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. The sales tax jurisdiction name is Portage which may refer to a local government division. The December 2020 total.

The Aurora sales tax rate is. You can print a 55 sales tax table here. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

Loading Do Not Show Again Close. Aurora collects a 16 local sales tax the maximum local sales tax allowed under Utah. There is no applicable county tax city tax or special tax.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Aurora is Colorados third largest city with a diverse population of more than 381000. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

The current total local sales tax rate in Aurora MO is. The sales tax jurisdiction name is Lawrenceburg which may refer to a local government division. There is no applicable county tax or special tax.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and. There is no applicable county tax or special tax. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

You can print a 7 sales tax table here. Did South Dakota v. This is the total of state county and city sales tax rates.

There is no applicable special. The Colorado sales tax rate is currently. Skip to Main Content.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. The 55 sales tax rate in Aurora consists of 45 South Dakota state sales tax and 1 Aurora tax. The December 2020 total.

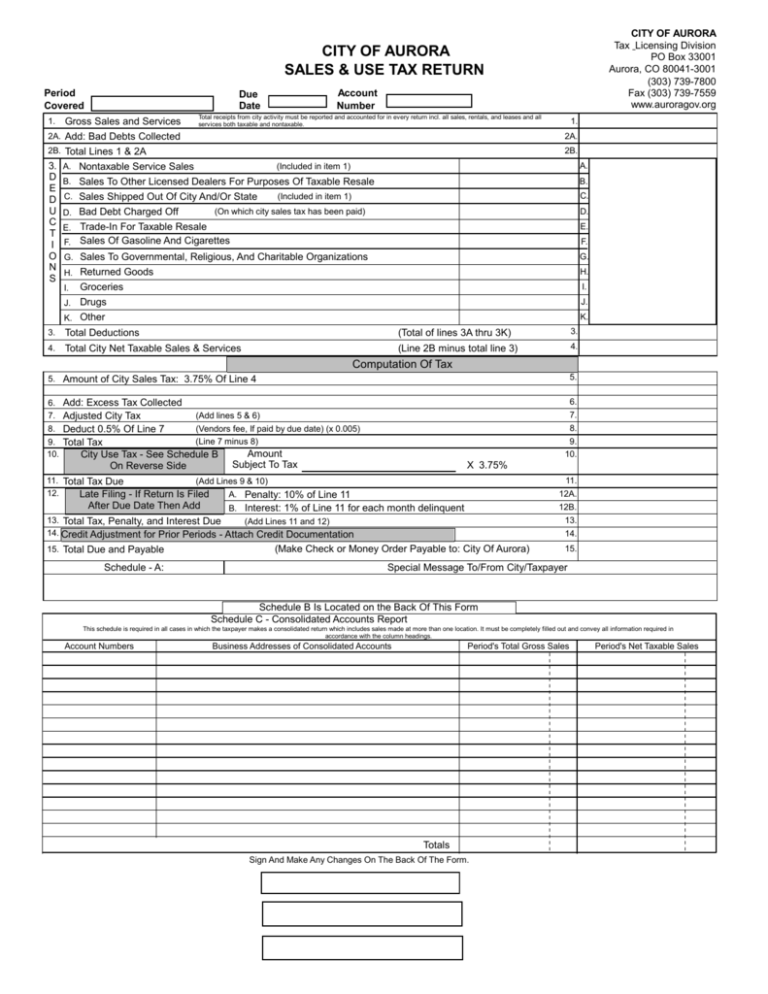

The minimum combined 2022 sales tax rate for Aurora Colorado is. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. You can print a 825 sales tax table here.

6 rows Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. The sales tax jurisdiction name is Venice which may refer to a local government division. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

The current total local sales tax rate in Aurora OR is 0000. 4 rows The current total local sales tax rate in Aurora CO is 8000. Wayfair Inc affect New York.

The 7 sales tax rate in Aurora consists of 7 Indiana state sales tax. The 2018 United States Supreme Court decision in South Dakota v. The Aurora sales tax rate is.

There is no applicable city tax or special tax. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The 7 sales tax rate in Aurora consists of 575 Ohio state sales tax and 125 Portage County sales tax.

Sales Tax The City of Auroras tax rate is 8850 and is broken down as follows. City of Aurora 250. The County sales tax rate is.

Aurora Kane County Illinois Sales Tax Rate

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Colorado Sales Tax Rates By City County 2022

Aurora To Become First Colorado City To Exempt Diapers Adult Incontinence Products From City Sales Tax

Ohio Sales Tax Rates By City County 2022

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Kansas Sales Tax Rates By City County 2022

How Colorado Taxes Work Auto Dealers Dealr Tax

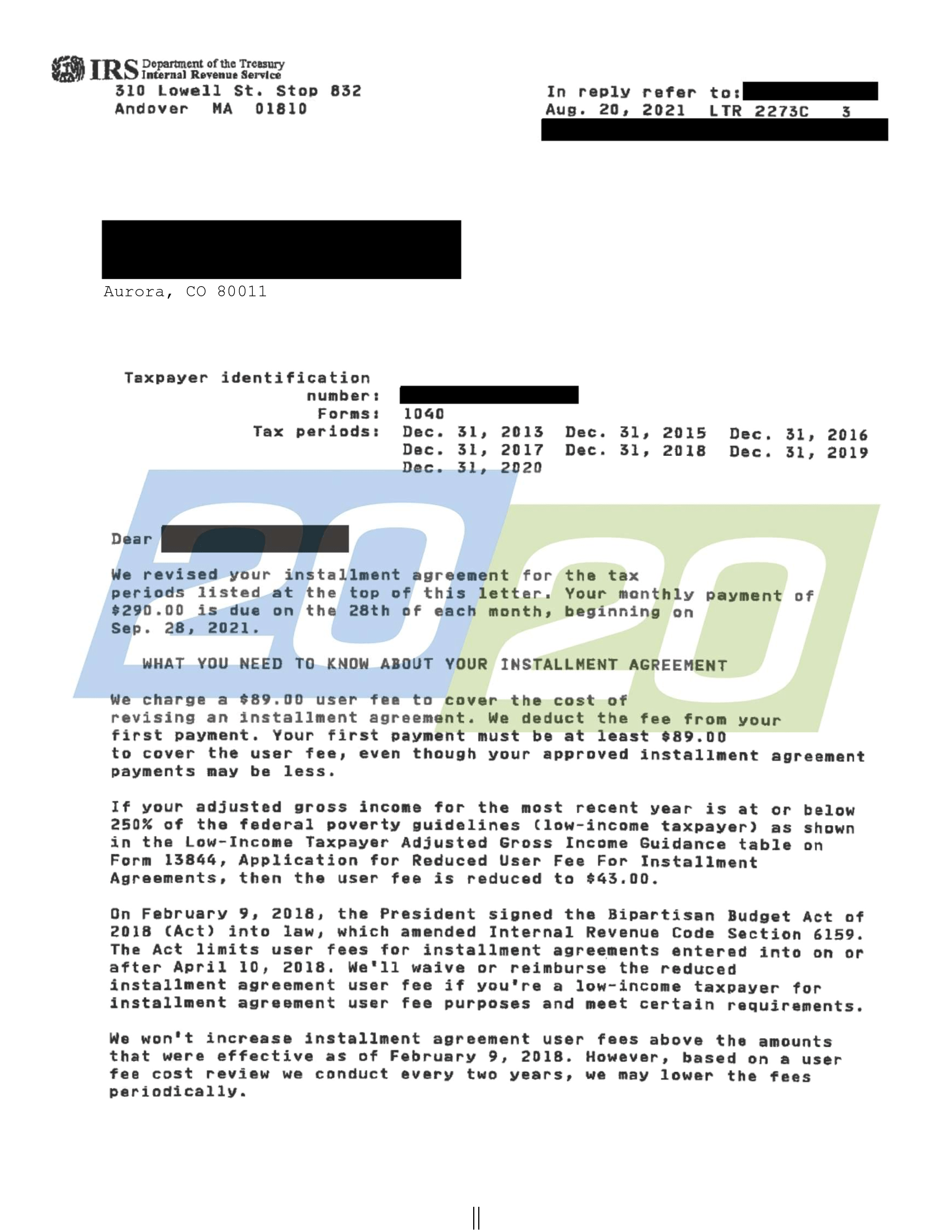

Tax Resolutions In Colorado 20 20 Tax Resolution

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Nebraska Sales Tax Rates By City County 2022

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute